Nobody expects to get into a car accident, but they are common. It is important that all motorists know how to reach after a car accident, including their responsibilities in terms of insurance. This post will cover the main steps to take for policyholders after an accident to ensure that any claims are managed smoothly.

Immediate Actions & Reporting the Accident

Of course, safety must be a top priority after any accident. Once you have made sure that nobody is seriously injured, you need to exchange information with the other parties involved. You should also report the accident to your insurance provider as soon as possible, as failing to report might complicate accident claims down the line.

Collecting Evidence for a Strong Case

It is important that you are able to create an accurate sequence of events for the accident to support your case and help insurers assess damage and fault. This is why it is a good idea to take photos of the damage and any injuries sustained, find any video footage of the accident (CCTV or dash cam footage), and ask for witness details. It is not always easy to remember, especially if you are feeling shaken, but strong evidence can make all the difference.

Communicating With Your Insurer & Managing Excess

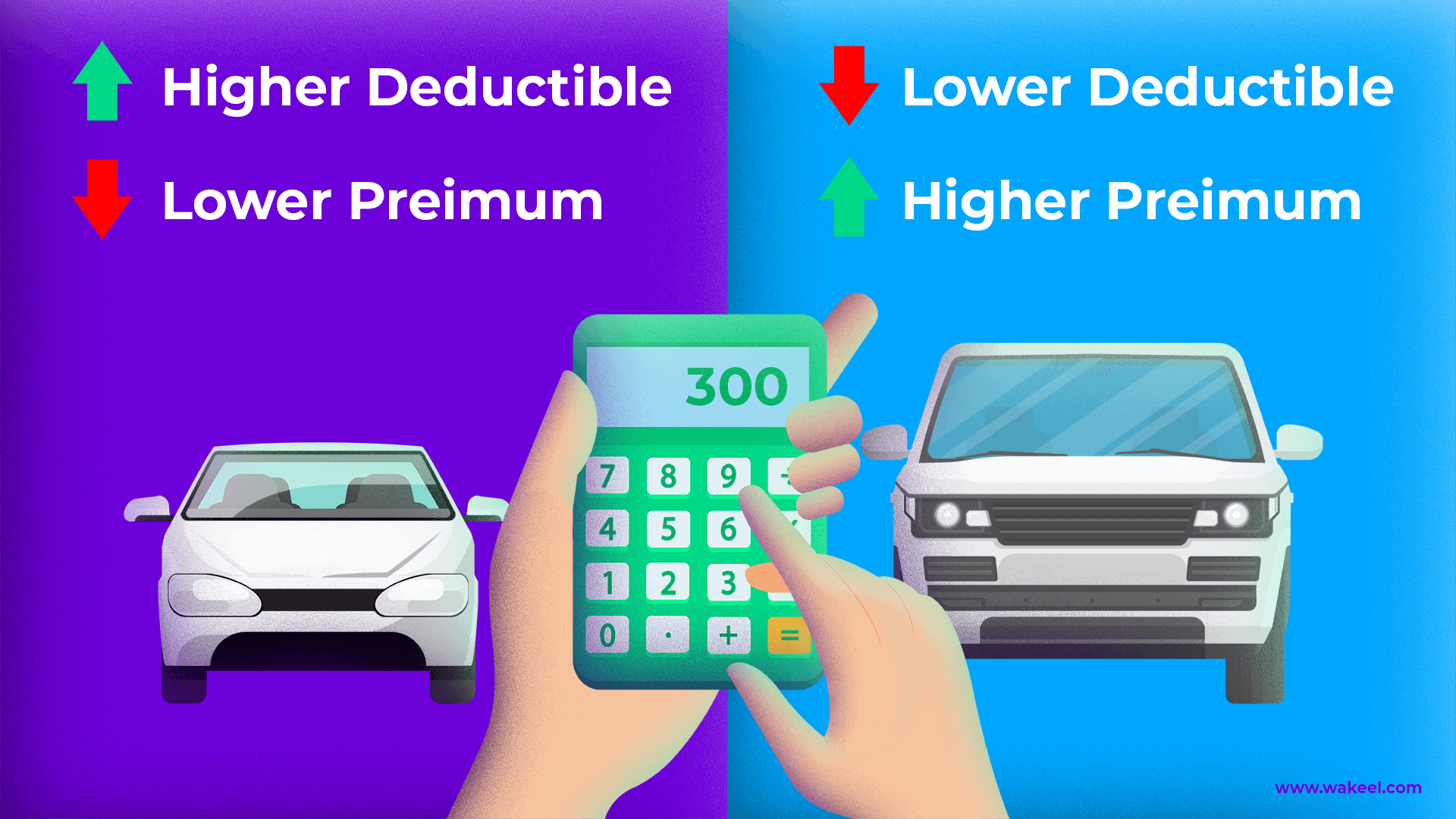

You will want to provide all of the information that you have to your insurance company, including a description of the accident (as best you can recall), photos/videos, and witness details. You may also need to discuss your excess at this time, which is the amount that you pay out of pocket before coverage begins. Some policyholders have a high excess to pay for these repairs for lower premiums, so it is important that you know how much your excess is.

Understanding No-Claims Protection & Future Premiums

Keep in mind that making a claim might affect your no-claims bonuses and future premiums. If you have no-claim protection, you can make a claim while protecting your bonus. If you do not have this protection in place, you may want to weigh up the costs and benefits before deciding to make a claim.

The information in this post should help you be prepared and understand your insurance obligations if you get into an accident. It is hoped that you never have to use this information, but it is vital that you know what steps need to be taken after the accident to ensure you comply with your policy requirements and that any claims are managed smoothly.