Car insurance is a fundamental aspect of financial protection for vehicle owners, providing coverage against accidents, theft, and other unforeseen events. However, one crucial component of Car Insurance Claims that policyholders must understand is the deductible—the out-of-pocket amount you must pay before your insurer covers the remaining cost of damages. Having a solid grasp of PCP Claims (Personal Car Protection Claims) and how deductibles influence the claims process can help you make well-informed decisions when choosing a policy or filing a claim.

What Is a Car Insurance Deductible?

A car insurance deductible refers to the fixed amount that you, as the policyholder, agree to pay before your insurance coverage kicks in. This amount is typically set when purchasing an insurance policy and applies whenever you file a claim. Deductibles help insurers manage risk by ensuring that policyholders take financial responsibility for a portion of their claim costs.

For example, suppose your policy includes a $500 deductible, and you file a Car Insurance Claim for $3,000 worth of damages. In this case, your insurer would cover $2,500, while you would pay the remaining $500. The deductible amount can significantly impact your claim payout, influencing both your financial obligations and insurance premiums.

Why Do Insurance Companies Use Deductibles?

The primary purpose of deductibles is to prevent frequent or minor claims that could strain insurance resources. By requiring policyholders to contribute a portion of the repair costs, insurers can maintain lower premium rates while discouraging frivolous claims. Here are three key reasons why deductibles are a standard part of PCP Claims:

- Cost Sharing – Insurers and policyholders share financial responsibility, reducing unnecessary claims and ensuring that the insurance system remains sustainable.

- Lower Premiums – Choosing a higher deductible often results in lower monthly premiums, making insurance more affordable for drivers willing to assume more risk.

- Fraud Prevention – Deductibles help deter fraudulent claims by ensuring that claimants have an actual financial stake in the process.

Types of Car Insurance Deductibles

Different types of Car Insurance Claims may require different deductibles, depending on the coverage type. Below are the most common deductible categories:

- Collision Deductible – Applies when your vehicle is damaged due to a collision with another car or an object, such as a fence or pole.

- Comprehensive Deductible – Covers non-collision-related incidents, including theft, vandalism, natural disasters, falling objects, or animal-related accidents.

- Uninsured Motorist Deductible – Comes into play when you’re involved in an accident with a driver who lacks insurance or has insufficient coverage.

- Personal Injury Protection (PIP) Deductible – Applies to medical expenses related to injuries sustained in an accident, regardless of fault.

Each deductible type serves a specific purpose and can significantly impact how much you pay out of pocket when filing a PCP Claim.

How Deductibles Affect Claims Processing

When filing a Car Insurance Claim, your deductible amount plays a key role in determining the payout you’ll receive. Here’s how it impacts the claims process:

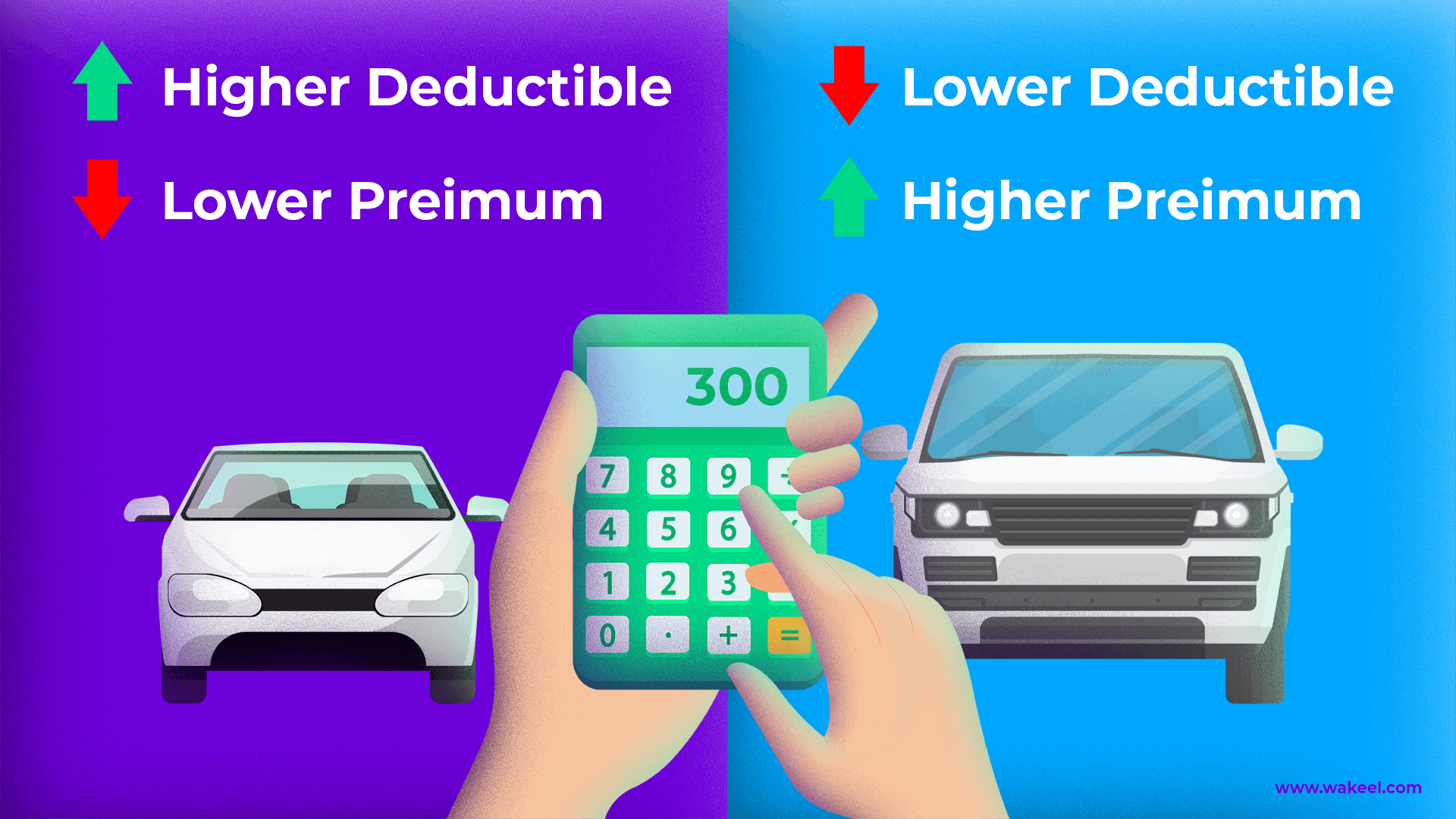

- Higher Deductibles, Lower Premiums – Choosing a higher deductible reduces your monthly premium costs, but means you’ll pay more when filing a claim.

- Lower Deductibles, Higher Premiums – Opting for a lower deductible decreases your upfront expenses during a claim, but results in higher premium costs.

- Deductible Applies Per Incident – If you file multiple PCP Claims within a short period, you must pay the deductible each time you submit a new claim.

- Claim Approval and Payouts – Insurance companies verify the claim details before issuing a payout, ensuring that the deductible is deducted correctly.

Understanding these factors can help policyholders strategically plan their deductible amounts to balance affordability and financial preparedness.

Selecting the Right Deductible for Your Policy

Choosing an appropriate deductible depends on your individual circumstances and risk tolerance. Consider the following factors when determining the best deductible amount for your Car Insurance Claims:

- Your Financial Situation – If you have sufficient emergency savings, opting for a higher deductible can help you enjoy lower premium costs.

- Driving Habits – If you frequently drive in areas prone to accidents or theft, selecting a lower deductible may provide better peace of mind.

- Vehicle Value – Older vehicles with lower market value may not require low deductibles since repair costs may not justify the higher insurance premiums.

- Likelihood of Filing Claims – Drivers with a history of frequent claims may benefit from policies with lower deductibles to reduce out-of-pocket expenses.

Assessing your personal needs and financial capabilities can help you select the right deductible amount for a well-balanced car insurance policy.

Strategies to Minimize Out-of-Pocket Costs

While deductibles are a standard part of Car Insurance Claims, there are ways to minimize your financial burden when filing a claim. Consider these strategies:

- Bundling Insurance Policies – Some insurers offer discounts for bundling multiple policies, such as home and auto insurance, reducing overall costs.

- Accident Forgiveness Programs – Certain insurers provide accident forgiveness benefits that prevent premium hikes after the first at-fault accident.

- Safe Driving Discounts – Maintaining a clean driving record can make you eligible for discounts, lowering insurance costs while improving safety.

- Reviewing Policy Terms Regularly – Periodically evaluating your insurance coverage ensures that your deductible aligns with your budget and needs.

Final Thoughts

Understanding car insurance deductibles is essential for making informed decisions when dealing with PCP Claims. Whether you prioritize lower monthly premiums or minimal out-of-pocket expenses during a claim, selecting the right deductible can help protect your finances while ensuring adequate coverage.

By familiarizing yourself with deductible types, how they influence claim payouts, and strategies to reduce expenses, you can navigate the Car Insurance Claims process with confidence. Before finalizing a policy, always review the terms and consult with your insurer to choose a deductible that best suits your needs.